To promote it as a leading asset management center, Japan is advancing a variety of reforms through cooperation with the public and private sectors. A range of events were held in the fall of 2023 aimed at investors and asset management companies from around the world, providing a great opportunity to communicate the appeal of Japan’s financial markets.

Speaking at PRI in Person Tokyo 2023, Prime Minister KISHIDA Fumio expressed the importance of Japan’s policies that will help solve the world’s problems and encourage corporate activities and investments to achieve sustainable growth.

Japan is undertaking various initiatives to promote it as a leading asset management center. One of these initiatives, dubbed “Japan Weeks” by the Financial Services Agency, was a series of events running from September to October 2023 that welcomed overseas investors and asset management companies to Japan.

Prime Minister KISHIDA Fumio also took the stage daily at related events to announce various moves to realize that goal. At PRI in Person Tokyo 2023, a forum for leading investors who are driving global responsible investment, he stated, “Our objective is that public pension funds reinforce their work on sustainable finance and spread the movement to the whole financial market.” The Principles for Responsible Investment (PRI) are advocated by the United Nations (UN) for the purpose of incorporating ESG (environmental, social, and governance) considerations into investors’ decision-making processes. At the forum, global stakeholders responsible for promoting the PRI were thrilled to hear Japan’s prime minister announce that at least seven representative public pension funds, worth 90 trillion yen, or some 600 billion dollars in assets under management (AUM), will start preparations for newly becoming signatories to the PRI.

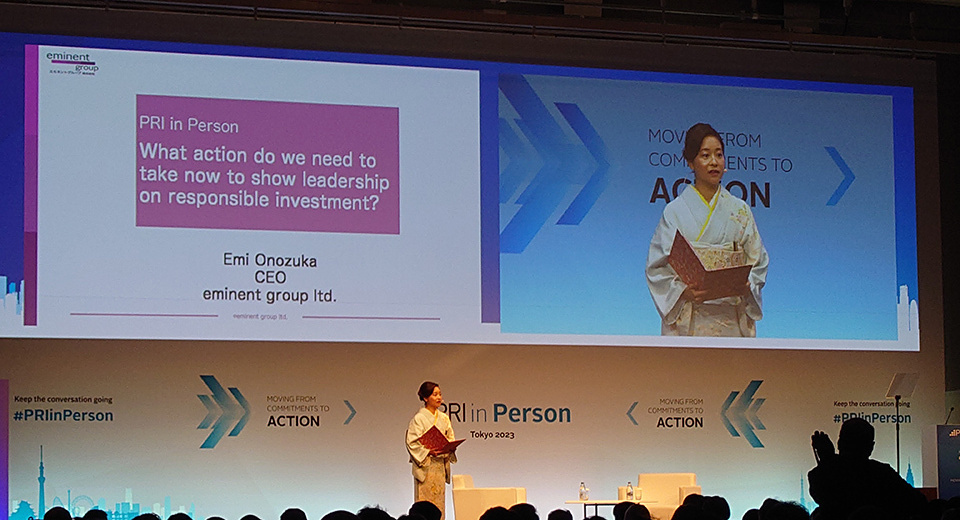

With such statements being made, how do Japan’s financial markets appear in the eyes of investors around the world? According to ONOZUKA Emi, president and CEO of Eminent Group, “Japan offers three attractive points as a capital market.” A specialist in sustainable finance, she has more than 20 years of experience as an institutional investor at several global financial institutions. Japan’s first big attraction is that it boasts nearly 4,000 listed companies, considerably more than other leading markets in Asia, indicating the country’s high liquidity and market depth. Japan’s second big draw is the level of trust in its regulators. Only with such trust can investors around the world focus on their investment activities. The third point is that Japan is fundamentally an open market in which anyone can participate. Some countries may have a greater number of companies or areas for investment, but they sometimes need to make further regulatory and supervisory improvements, and their markets are not always open to everyone. “Scale, trust, and openness: those are Japan’s three strengths,” affirms Onozuka.

Left: ONOZUKA Emi took the stage at PRI in Person Tokyo 2023 to give a speech on leadership, innovation, and responsible investing.

Right: Onozuka has more than 20 years of experience as an institutional investor, specializing in sustainable finance (ESG, impact investing). She engages in a wide range of activities, including advisory services, research, writing, and lectures on sustainable finance and business value creation.

Top: ONOZUKA Emi took the stage at PRI in Person Tokyo 2023 to give a speech on leadership, innovation, and responsible investing.

Bottom: Onozuka has more than 20 years of experience as an institutional investor, specializing in sustainable finance (ESG, impact investing). She engages in a wide range of activities, including advisory services, research, writing, and lectures on sustainable finance and business value creation.

She also goes on to say that Japan should focus on the following to become even more attractive as a market: “Many firms here need to improve their investment efficiency. In terms of winning investment from overseas, the pressing issues are top management being true to their words and better accountability as an outcome measure, as well as more English support.” In that regard, expectations are growing for the establishment of “special business zones for financial and asset management business,” which Prime Minister Kishida announced in New York in September 2023; the details will be announced by summer 2024. Various measures to enhance the business and living environment, including the improvement of administrative services in English, will be considered for the establishment of the special business zones.

Meanwhile, Onozuka has high hopes for Japan’s commitment to ESG investment, as made by Prime Minister Kishida at the recent PRI forum. “For domestic and international investors, improving corporate governance and addressing sustainability issues have become essential prerequisites for evaluating and funding a company. Accelerating sustainable finance, which is strengthened through the joint efforts of the public and private sectors, should become an additional advantage of the Japanese market. If we can capitalize on that, there is a good chance that the domestic market will take a leadership role in transition finance regionwide in Asia.”

With Prime Minister Kishida’s determination, Japan will continue to work together with both the public and private sectors to make its financial markets even more robust and sustainable.