Visit to Europe: First Day

Cabinet Secretariat, Tuesday, October 16, 2018

[Provisional Translation]

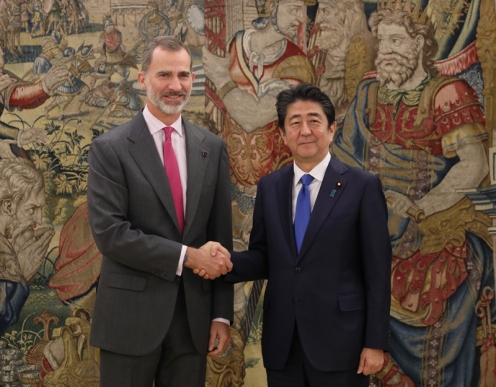

On October 16, 2018 (local time), Prime Minister Shinzo Abe visited Madrid in the Kingdom of Spain.

The Prime Minister was first received in audience by His Majesty the King Felipe VI of the Kingdom of Spain. After that, he held a meeting with H.E. Mr. Pedro Sánchez Pérez-Castejón, President of the Government of Spain, and signed the Convention Between Japan and the Kingdom of Spain for the Elimination of Double Taxation with Respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance.

Signing of the New Tax Convention between Japan and Spain

Foreign Affairs, Tuesday, October 16, 2018

1. On October 17, 2018, “Convention between Japan and the Kingdom of Spain for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance&rdquo” (hereinafter referred to as the New Convention) was signed in Madrid by Mr. Sinzo Abe, Prime Minister of Japan and H.E. Mr. Pedro Sánchez Pérez-Castejón, President of the Government of Spain.

2. The New Convention wholly amends the existing Convention, which entered into force in 1974, by revising the taxation on business profits, expanding the extent of reduction of taxation on investment income, introducing measures for prevention of abuse of the New Convention, arbitration proceedings in mutual agreement procedures and assistance in the collection of tax claims, and reinforcing the exchange of information concerning tax matters. It is expected that, while eliminating double taxation and preventing international tax evasion and tax avoidance, the New Convention promotes further mutual investments and economic exchanges between the two countries.

3. The following are the key points of the New Convention.

(1) Taxation on Business Profits

Where an enterprise of one of the two countries has in the other country a permanent establishment (such as a branch) through which the enterprise carries on business, only the profits attributable to the permanent establishment may be taxed in that other country. The profits attributable to a permanent establishment will be calculated by comprehensively recognizing internal dealings between its head office and branches and by strictly applying the arm’s length principle.

(2) Taxation on Investment Income

Taxation on investment income (dividends, interest and royalties) in the source country will be subjected to the reduced maximum rates or exempted as follows:

Dividends

Existing Convention: 10% (holding at least 25% of voting power for 6 months)

New Convention: Exempted (holding at least 10% of voting power for 12 months)

Existing Convention: 15% (others)

New Convention: Exempted (beneficially owned by pension funds)

New Convention: 5% (others)

Interest

Existing Convention: 10%

New Convention: Exempted

Royalties

Existing Convention: 10%

New Convention: Exempted

(3) Prevention of Abuse of the New Convention

In order to prevent abuse of benefits under the New Convention, it is provided that only residents who satisfy specified conditions, such as qualified persons, may be entitled to the exemption from tax on investment income. In addition, any benefit under this Convention will not be granted if it is reasonable to conclude that obtaining such a benefit was one of the principal purposes of any transaction, or if the income is attributable to a permanent establishment in a third country and does not satisfy specified conditions.

(4) Mutual Agreement Procedure and Arbitration Proceedings

Taxation not in accordance with the provisions of the New Convention may be resolved by mutual agreement between the tax authorities of the two countries. In addition, where such taxation has not been resolved through the consultation between the tax authorities of the two countries within two years, the unresolved issue will be resolved pursuant to a decision of an arbitration panel composed of third parties.

(5) Exchange of Information and Assistance in the Collection of Tax Claims

In order to effectively prevent international tax evasion and tax avoidance, the scope of cases and taxes subject to the exchange of information concerning tax matters is expanded and the mutual assistance in the collection of tax claims between the two countries is introduced.

4. After the completion of the necessary domestic procedures in each of the two countries (in the case of Japan, approval by the Diet is necessary), each of the two countries shall send through diplomatic channels to the other country the notification confirming the completion of its internal procedures. The New Convention will enter into force on the first day of the third month following the month of receipt of the latter notification and will have effect:

(a) with respect to taxes levied on the basis of a taxable year, for taxes for any taxable years beginning on or after January 1 in the calendar year next following that in which the New Convention enters into force; and

(b) with respect to taxes levied not on the basis of a taxable year, for taxes levied on or after January 1 in the calendar year next following that in which the New Convention enters into force.

(c) The provisions concerning the exchange of information and the assistance in the collection of taxes have effect from the date of entry into force of the New Convention without regard to the date on which the taxes are levied or the taxable year to which the taxes relate.

Visit to Europe: Second Day

Cabinet Secretariat, Wednesday, October 17, 2018

[Provisional Translation]

On October 17, 2018 (local time), Prime Minister Shinzo Abe visited Paris in the French Republic.

The Prime Minister first held a joint press announcement with H.E. Mr. Emmanuel Macron, President of the French Republic, followed by a summit meeting (working lunch).

Afterwards, Prime Minister Abe attended a dinner with French representatives of Japonismes.

25th APEC Finance Ministers’ Meeting (Port Moresby, Papua New Guinea, 17 October 2018)

Ministry of Finance, Wednesday, October 17, 2018

We, the Finance Ministers of the economies of Asia-Pacific Economic Cooperation (APEC), convened our 25th meeting in Port Moresby, Papua New Guinea on 17 October 2018 under the chairmanship of the Honourable Charles Abel, Deputy Prime Minister and Treasurer of Papua New Guinea.

Global and Regional Economy

In support of the APEC 2018 theme, Harnessing Inclusive Opportunities, Embracing the Digital Future, we discussed the economic and financial outlook that our economies face and shared views on appropriate policy actions.

Since we met in October 2017 global growth has remained robust. However, growth has become less balanced and downside risks have risen in the past six months. Downside risks to global growth include heightened trade and geopolitical tensions, rising financial vulnerabilities, high and growing debt levels against a background of tighter financial conditions, global imbalances, inequality and structurally weak growth.

We recognise that, to broaden and sustain the current expansion and raise medium-term growth prospects for the benefit of all, our economies must advance policies and reforms that increase productivity and strengthen the potential for inclusive growth, while building resilience to deal with financial and economic downturns. Structural reforms will play an important role in achieving APEC’s growth objectives.

We are committed to use all monetary, fiscal and structural policy tools, individually and collectively to the extent possible, to achieve strong, sustainable, balanced and inclusive growth. Fiscal policy should be flexible and growth-friendly, prioritising high quality investment and inclusiveness, while enhancing economic and financial resilience and ensuring that public debt as a share of GDP is on a sustainable path. Monetary policy should continue to support economic activity and ensure price stability, consistent with central banks’ mandates. Strong fundamentals, sound policies and a resilient international monetary system are essential to the stability of exchange rates, contributing to strong and sustainable growth and investment. Flexible exchange rates, where feasible, can serve as a shock absorber. We recognize that excessive volatility or disorderly movements in exchange rates can have adverse implications for economic and financial stability. We will refrain from competitive devaluation and will not target our exchange rates for competitive purposes.

Accelerating Infrastructure Development and Financing

Infrastructure is crucial to lifting productivity, enhancing connectivity and competitiveness, creating jobs and strengthening inclusive growth. The Asia-Pacific region faces a significant infrastructure financing deficit with data from the Global Infrastructure Hub (GIH) estimating that investment needs are expected to average US$2.1 trillion per year over the 2020-2025 period. This large and growing infrastructure investment need can be addressed by diversifying the available sources of long-term finance and fostering private sector involvement, including the creation of enabling conditions for attracting investment, generating pipelines of ‘bankable’ infrastructure projects and developing financing structures capable of attracting long-term institutional investor capital. Stressing the importance of quality infrastructure investment, we encourage capacity-building programs to improve economies’ project evaluation processes, regulatory and procurement environments, and project preparation and financing capabilities.

We welcome the hosting in March 2018 of a Seminar on Accelerating Infrastructure Development and Financing, which provided an opportunity to share economies’ experiences and good practices on planning, financing and delivering quality infrastructure. We also welcome the APEC/OECD package on Selected Effective Approaches to Financing Infrastructure in APEC Economies.

Recognising the cross-cutting nature of infrastructure development we welcome the 2018 APEC Economic Policy Report (AEPR): Structural Reform and Infrastructure developed by APEC Senior Finance Officials (SFOM) and the Economic Committee (EC), which highlights a menu of structural policies and encourages member economies to develop efficient long-term planning processes, ensure that institutional arrangements are conducive to private sector provision and financing, and undertake due diligence and incorporate resiliency into decisionmaking for promoting quality infrastructure.

To accelerate infrastructure development and financing we urge member economies to adopt policy approaches that will strengthen institutions and practices to improve infrastructure planning, evaluation and delivery in order to facilitate a substantial increase in the number of well-prepared and investment-ready infrastructure projects. In order to meet communities’ expectations and development needs, we encourage approaches that follow good practices, facilitate project transparency, ensure timely access to qualitative and quantitative project information, and promote opportunities to potential investors. We will consider how best to ensure that our efforts to meet infrastructure financing needs are consistent with sustainable financing practices.

Advancing Financial Inclusion

Financial inclusion is a fundamental building block of inclusive growth and development. It enables individuals and businesses to access useful and affordable financial products and services that meet their needs, facilitating poverty alleviation, productive asset accumulation, and shared prosperity. It also increases citizens’ resilience to the shocks that can threaten their livelihoods. While the needs and priorities of our economies vary in nature and degree, we recognise the importance of achieving universal financial access and usage across the Asia- Pacific region.

We welcome the hosting in June 2018 of a Seminar on Financial Inclusion in APEC: Financial capability, education and technology, which provided a valuable forum for sharing economy experiences and good practices on how financial literacy and innovation can advance financial inclusion. We also welcome the hosting in June 2018 of Improving Digital Financial Literacy in APEC (pilot workshop for Papua New Guinea), which focused on strengthening consumer digital financial literacy and awareness.

We note the OECD/INFE interim report on Financial Education in APEC Economies and we look forward to the final report in 2019. We also note the SFOM’s development of a capacity building package on advancing financial inclusion in APEC economies and look forward to its completion in 2019, continuing the work of the Finance Ministers’ Process (FMP) on this important topic and helping to progress the APEC Action Agenda on Advancing Economic, Financial and Social Inclusion.

We note that, to advance financial inclusion, a number of member economies are developing and implementing domestic strategies and have made commitments at the multilateral level, for example, endorsing the Maya Declaration and the Universal Financial Access by 2020 commitment at the 2015 WBG-IMF Spring Meetings. We welcome member economies taking practical steps to advance financial inclusion and encourage full and effective implementation of their domestic strategies and commitments.

Fostering International Tax Cooperation and Transparency

Implementation of the OECD/G20 Base Erosion and Profit Shifting (BEPS) Package’s minimum standards and other relevant BEPS actions through the BEPS Inclusive Framework and internationally-agreed standards on transparency and exchange of information (EOI) for tax purposes remain a priority for our economies. We welcome efforts in 2018 to promote mutual support through the hosting in July 2018 of an Advancing BEPS and Automatic Exchange of Information priorities in APEC technical seminar, the launching of the APEC-BEPS Community of Practice on the Knowledge Sharing Platform for Tax Administrations, continued engagement with the Global Forum on Transparency and Exchange of Information for Tax Purposes, and discussions on the tax challenges arising from digitalisation that drew on work undertaken by the OECD and G20. These efforts have built on the FMP’s work of 2017 and we welcome further efforts to be channelled through Chile’s host year in 2019.

Recognising the importance of international tax cooperation, we encourage all member economies to continue to work towards a fair, sustainable and modern international tax system and for APEC to continue to support efforts to enhance the certainty, transparency and fairness of the tax system.

Implementing the Cebu Action Plan

The Cebu Action Plan (CAP) provides the FMP with a voluntary and non-binding 10-year roadmap for building an APEC community that is more financially integrated, transparent, resilient and connected.

We welcome the efforts made by member economies to submit initiatives under the CAP’s first package and in updating the progress of their implementation as appropriate to their domestic circumstances. We also welcome member economies nominating additional initiatives under the CAP’s second package and encourage future updates and other efforts to ensure that the CAP is implemented effectively and remains a valuable reference for policymakers.

We acknowledge the active engagement of the APEC Business Advisory Council (ABAC) in supporting CAP implementation. We welcome ABAC’s roadmaps on financial market infrastructure and micro insurance and encourage relevant authorities to collaborate with ABAC and the Asia-Pacific Financial Forum (APFF) in using them where appropriate. We note the work of ABAC and the APFF in promoting regional public-private platforms for financial innovation and digitalisation, cross-border data ecosystems and personal insolvency reform, and look forward to this work being advanced next year. We also note the contribution of the 2018 Asia-Pacific Financial Inclusion Forum and ABAC’s companion report to the 2018 AEPR on structural reform and digital infrastructure.

Disaster Risk Financing and Insurance

We recognise the importance of developing robust financial management to address increasing disaster risk in the Asia-Pacific region and welcome the work of the APEC Working Group on Disaster Risk Financing and Insurance (DRFI) in 2018, with support from the WBG as a lead technical facilitator and OECD and other international organisations, to help member economies address the economic and financial risk caused by natural disasters.

We welcome the hosting in June 2018 of an APEC Workshop on the Financial Management of Public Assets against Disaster Risks. We also welcome the report on Catastrophe Insurance Programs for Public Assets – Operational Framework, developed by the WBG in coordination with member economies, and the information and analysis on economy approaches to managing disaster-related contingent liabilities in the report by the WBG and OECD on Policy Lessons on Managing Disaster-Related Contingent Liabilities in Public Finance Frameworks. We look forward to continued cooperation and knowledge exchange on DRFI, particularly on financial risk for quality and resilient infrastructure against natural disasters.

Other Issues

We welcome enhanced collaboration between the SFOM and EC this year which, consistent with the FMP Modernisation Strategy, is critical to promoting greater coherence in APEC’s work and ensuring that the FMP and Senior Officials’ Meeting (SOM) processes are mutually supportive. We encourage further collaboration where there are clear, mutually beneficial objectives and where it can be conducted efficiently. We encourage SFOM and EC to further discuss collaboration on the 2019 AEPR on Structural Reform and the Digital Economy.

We commend ABAC for its contribution in 2018 and encourage continued private sector engagement in 2019. We appreciate the support that the ADB, Foundation for Development Cooperation, GIH, IMF, OECD, UN Capital Development Fund, WBG and APEC Policy Support Unit have provided to the FMP this year and encourage these and other organisations to continue to offer technical assistance and capacity building support to help member economies deliver strong, sustainable, balanced and inclusive growth.

We thank Papua New Guinea for hosting the APEC Finance Ministers’ Process this year. We will meet again for our 26th meeting in Chile in October 2019.

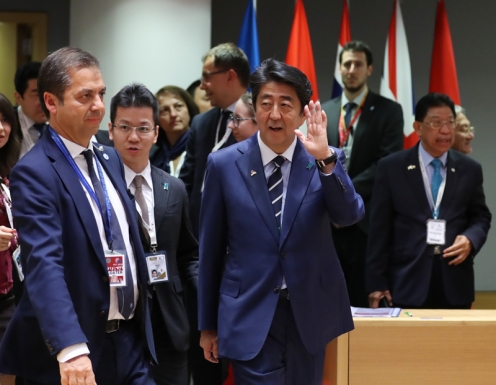

Visit to Europe: Third Day & ASEM Summit Meeting: First Day

Cabinet Secretariat, Thursday, October 18, 2018

[Provisional Translation]

On October 18, 2018 (local time), Prime Minister Shinzo Abe, who is visiting Paris in the French Republic, visited the “Jomon – Birth of art in prehistoric Japan” exhibit of Japonismes 2018. Afterwards, the Prime Minister received a courtesy call from H.E. Ms. Audrey Azoulay, Director-General of the United Nations Educational, Scientific and Cultural Organization (UNESCO).

In the afternoon, Prime Minister Abe visited Brussels in the Kingdom of Belgium and held a summit meeting with H.E. Mr. Peter Pellegrini, Prime Minister of the Slovak Republic, H.E. Mr. Andrej Babiš, Prime Minister of the Czech Republic, H.E. Mr. Mateusz Morawiecki, Prime Minister of the Republic of Poland, and H.E. Mr. Viktor Orbán, Prime Minister of Hungary, followed by a summit meeting with H.E. Mr. Jean-Claude Juncker, President of the European Commission. Afterwards, the Prime Minister held a summit meeting with H.E. Dr. Angela Merkel, Federal Chancellor of the Federal Republic of Germany.

In the evening, Prime Minister Abe attended the opening ceremony of the 12th Asia-Europe Meeting (ASEM) Summit Meeting.

Signing of the Tax Agreement between Japan and Croatia

Foreign Affairs, Friday, October 19, 2018

1. On October 19, 2018, “the Agreement between Japan and the Republic of Croatia for the Elimination of Double Taxation with respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance” (hereinafter referred to as the Agreement) was signed in Zagreb by Mr. Kenji Yamada, Parliamentary Vice-Ministers for Foreign Affairs of Japan and Dr. Zdravko Marić,Minister of Finance of the Republic of Croatia.

2. For the purpose of eliminating double taxation arising between the two countries, this Agreement clarifies the scope of taxable income in the two countries. In addition, this Agreement will enable the tax authorities of the two countries to consult each other on taxation not in accordance with the provisions of this Agreement, to exchange information concerning tax matters and to mutually lend assistance in the collection of tax claims. It is expected that, while eliminating double taxation and preventing international tax evasion and tax avoidance, this Agreement promotes further mutual investments and economic exchanges between the two countries.

3. The following are the key points of the Agreement.

(1) Taxation on Business Profits

Where an enterprise of one of the two countries has in the other country a permanent establishment (such as a branch) through which the enterprise carries on business, only the profits attributable to the permanent establishment may be taxed in that other country. The profits attributable to a permanent establishment will be calculated by comprehensively recognizing internal dealings between its head office and branches and by strictly applying the arm’s length principle.

(2) Taxation on Investment Income

Taxation on investment income (dividends, interest and royalties) in the source country will be subjected to the maximum rates or exempted as follows:

Dividends Exempted (holding at least 25% of voting power for 365 days)

5% (others)

Interest Exempted (received by the Governments, etc.)

5% (others)

Royalties 5%

(3) Prevention of Abuse of the Agreement

In order to prevent abuse of benefits under this Agreement, in principle, qualified persons who satisfy specified conditions may exclusively be entitled to the exemption from tax on dividends. In addition, any benefit under this Agreement will not be granted if it is reasonable to conclude that obtaining such a benefit was one of the principal purposes of any transaction, or if the income is attributable to a permanent establishment in a third country and does not satisfy specified conditions.

(4) Mutual Agreement Procedure

Taxation not in accordance with the provisions of this Agreement may be resolved by mutual agreement between the tax authorities of the two countries.

(5) Exchange of Information and Assistance in the Collection of Tax Claims

In order to effectively prevent international tax evasion and tax avoidance, the exchange of information concerning tax matters and the mutual assistance in the collection of tax claims between the two countries are introduced.

4. After the completion of the necessary domestic procedures in each of the two countries (in the case of Japan, approval by the Diet is necessary), each of the two countries shall send through diplomatic channels to the other country the notification confirming the completion of its internal procedures. This Agreement will enter into force on the thirtieth day after the date of receipt of the latter notification and will have effect:

(a) with respect to taxes levied on the basis of a taxable year, for taxes for any taxable years beginning on or after January 1 in the calendar year next following that in which this Agreement enters into force; and

(b) with respect to taxes levied not on the basis of a taxable year, for taxes levied on or after January 1 in the calendar year next following that in which this Agreement enters into force.

(c) The provisions concerning the exchange of information and the assistance in the collection of taxes have effect from the date of entry into force of this Agreement without regard to the date on which the taxes are levied or the taxable year to which the taxes relate.

Prime Minister Shinzo Abe’s Interview with Phoenix TV (Hong Kong)

Foreign Affairs, Thursday, October 18, 2018

Prior to his visit to China, Prime Minister Shinzo Abe delivered a message about Japan's perspective on the Japan-China relations, in the interview with Phoenix TV (Hong Kong) held on October 12. The interview was broadcasted throughout China on October 16 (Beijing Time).

Courtesy Call from the President of the World Bank Group and Others

Cabinet Secretariat, Monday, October 15, 2018

[Provisional Translation]

On October 15, 2018, Prime Minister Shinzo Abe received a courtesy call from Dr. Jim Yong Kim, President of the World Bank Group, and others at the Prime Minister’s Office.

Follow-up Meeting for the Work Style Reform

Cabinet Secretariat, Monday, October 15, 2018

[Provisional Translation]

On October 15, 2018, Prime Minister Shinzo Abe held the First Follow-Up Meeting for the Work Style Reform at the Prime Minister’s Office.

At the meeting, a discussion was held on the Act on Arrangement of Relevant Act on Promoting the Work Style Reform and the progress of the Action Plan for the Realization of Work Style Reform.

Based on the discussion, the Prime Minister said,

“The work style reform is the greatest challenge in realizing a society in which all citizens are dynamically engaged, which is the Abe administration’s goal. In the previous ordinary session of the Diet, which we framed as a “Work Style Reform Diet,” we achieved our first major reforms in the 70 years since the enactment of the Labor Standards Act, including correcting the practice of working long hours and realizing equal pay for equal work, with the enactment of the Work Style Reform Bills.

The Government must work in unity towards the smooth implementation of the new system. Today, the experts here gave us valuable comments. For example, in response to the comment that the consultation services for small and medium-sized enterprises (SMEs) should be further enhanced, we will work on strengthening the consultation function of the Work Style Reform Promotion and Assistance Centers that have been established in all prefectures. At the same time, we will also take measures in the areas that were pointed out, such as supporting employees in striking a balance between medical treatment and work, and promoting the employment of persons with disabilities, while firmly implementing the PDCA cycle in accordance with the Action Plan for the Realization of Work Style Reform.

Looking ahead to an era in which everyone can play an active role throughout their life, it is necessary for us to promote initiatives toward building a social security system oriented to all generations. To that end, we will advance employment reform towards such an era, including preparing the conditions for raising the age limit for continuous employment above 65, and significantly expanding mid-career recruitment, as the second stage of the work style reform.

Based on the views that we have received from the expert members today, I would like the relevant ministers to take steps to implement the relevant measures swiftly.”

Signing of the Enhanced Bilateral Swap Arrangement between Japan and Indonesia

Ministry of Finance, Monday, October 15, 2018

The Bank of Japan, acting as agent for the Minister of Finance of Japan, and the Bank Indonesia signed the second Amendment and Restatement Agreement of the third Bilateral Swap Arrangement on October 14, 2018. This amendment enables Indonesia to swap its local currency against the Japanese Yen in addition to the US dollars. The size of the facility remains unchanged, up to 22.76 billion US dollars or equivalent.

The enhanced Bilateral Swap Arrangement reflects the strengthened bilateral financial cooperation between Japan and Indonesia. This will contribute to the stability of financial markets, promote the use of local currencies, including the Japanese Yen, in Asia in the medium term, and thereby further develop the growing economic and trade ties between Japan and Indonesia.

FY2018 Troop Review for the Anniversary of the Establishment of the Self-Defense Forces

Cabinet Secretariat, Sunday, October 14, 2018

[Provisional Translation]

On October 14, 2018, Prime Minister Shinzo Abe attended the FY2018 Troop Review for the Anniversary of the Establishment of the Self-Defense Force, held at the Asaka Training Area of the Ground Self-Defense Force.

After receiving a salute, the Prime Minister reviewed the units, delivered an address, and held an award ceremony. Following that, the Prime Minister reviewed a parade, and observed an aerobatic flight exhibition and a celebratory parade by the U.S. Forces, among other events.

Memorial Service for Members of the Self-Defense Forces Who Lost Their Lives on Duty

Cabinet Secretariat, Saturday, October 13, 2018

[Provisional Translation]

On October 13, 2018, Prime Minister Shinzo Abe attended the FY2018 Memorial Service for Members of the Self-Defense Forces (SDF) Who Lost Their Lives on Duty, held at the Ministry of Defense.

The Prime Minister offered a silent prayer and delivered a memorial address, followed by the offering of a flower.

The Prime Minister said in his memorial address,

“On the occasion of the FY2018 Memorial Service for Members of the Self-Defense Forces Who Lost Their Lives on Duty, I reverently express my sincere condolences for the souls of the SDF members who lost their lives while fulfilling their noble duty to ensure the survival of Japan.

This year, the souls of 30 members were enshrined.

To protect the lives and peaceful livelihoods of the Japanese people—you were committed to carrying out this most important and challenging mission. In each of your positions, in the air, on the seas, or on the ground, you devoted yourself to your duties with a strong sense of mission and responsibility. You are the pride of our country.

We shall never forget your bravery nor your names. At the same time, I feel unbearable grief when I give thought to the deep sorrow and cherished memories of those who have lost their precious family members. Once again, I wish to express our profound respect and gratitude to the 1,964 souls who have been enshrined here.

I pledge that your precious sacrifice shall not be in vain. We will uphold your wishes and resolutely protect the lives and peaceful livelihoods of the Japanese people. I firmly promise that we will do everything in our power to contribute to global peace and stability.

I offer my heartfelt prayer for the repose of the souls of the fallen SDF members, and for the peace of mind and good health of their bereaved family members.”

Council for Promotion of Regulatory Reform

Cabinet Secretariat, Friday, October 12, 2018

[Provisional Translation]

On October 12, 2018, Prime Minister Shinzo Abe attended the 37th meeting of the Council for Promotion of Regulatory Reform at the Prime Minister’s Office.

During the meeting, a discussion was held on the future proceedings of the Council for Promotion of Regulatory Reform and the priority issues for the third phase of the Council.

Based on the discussion, the Prime Minister said,

“The world is changing dramatically through the fourth industrial revolution. We will advance reforms by breaking down regulations and institutions that are rigid like bed-rock and prevent people from taking on new challenges. That resolve of the Abe Cabinet is unwavering. Today, the members of this Council have proposed the priority issues that should be addressed going forward.

The fourth industrial revolution brings groundbreaking innovations to a wide range of sectors, including finance, communications, and education. To further accelerate this trend, the Cabinet will exert its efforts, working in unity, to eliminate the governance gaps in regulations and institutions of various fields, such as by promoting online education and frequency band system reforms. The greatest challenge confronting our nation is the declining birthrate and aging of society. We must urgently implement measures to enhance child rearing and nursing care, such as institutional reforms to mitigate the childcare problems known as the “First Grade Wall” which parents face when their children enter elementary school, as well as those aimed at reducing to zero the number of people leaving employment to offer nursing care to their family members. Regulatory reforms are also the key to a strong regional revitalization process. We will also implement reforms that generate regional vitality, including reviewing regulations, such as those preventing the active use of drones, in order to turn agriculture into a growth industry.

Regulatory reform is the main engine for growth that will pave the way to a new era. It is at the core of the Abe Cabinet’s growth strategy. I ask for the cooperation of all members of this Council in materializing bold regulatory reforms.”

Goal of Doubling Rice Production in Sub-Saharan Africa in 10 Years to Be Met in 2018

JICA, Friday, October 19, 2018

It is now certain that a bold goal for rice production in Sub-Saharan Africa will be met: Doubling the amount produced between 2008 and 2018.

The effort has been led by the Coalition for African Rice Development (CARD), which JICA jointly launched with the international NGO Alliance for a Green Revolution in Africa (AGRA) at the fourth Tokyo International Conference for African Development (TICAD IV) in 2008. Rice production in Sub-Saharan Africa, which stood at 14 million metric tons in 2008, is projected to reach 28 million metric tons this year.

The key to achieving this goal is not just "on-farm" assistance, such as introducing rice varieties that fit the diverse African agro-ecologies, improving irrigation facilities, and disseminating rice growing techniques to the farmers. It is also essential to formulate and implement strategic national plans to stimulate rice production in each country. These plans bring efficiency to the flow from production to processing, distribution and sales, thereby increasing the value added to rice that eventually sells well in the market. The Coalition joined forces with the governments of the 23 member countries and 11 international development partners, and took the lead in ehnancing the rice value-chain in each country to achieve the goal of doubling the rice production.

Focusing on the competitiveness of the domestic rice

Hiroshi Hiraoka, a JICA senior advisor, pushed the initiative forward as the coordinator at the CARD Secretariat in Nairobi, Kenya, for four years after its inauguration in 2008. He found that the weak progress in increasing rice production in Africa was because the taste and quality of domestically grown rice failed to meet consumers' preferences. Consequently farmers, facing weak demand for local rice, were not incentivized to boost their production.

The 23 CARD member countries have vast amounts of land that is suitable for growing rice but remain untapped, meaning that there is huge potential for them to be self-sufficient in rice. On the other hand, a lack of initiatives aimed at disseminating varieties that suit consumer tastes as well as low processing quality (broken grains and impurities) due to the poor post-harvest processing techniques result in weak demand for domestic rice in many countries, and it sells at low prices even if it finds its way to the market.

As such, the prevailing cost-benefit structure of rice production, coupled with numerous unpredictable factors on and off the farm, is not convincing enough for most rice growers to justify the incremental cost for fertilizers and farm equipment, or for the operation and maintenance of irrigation facilities, Mr. Hiraoka says. As a result, the rapid increase in the demand for rice in Africa, based on economic growth and urbanization, has not been well captured by the domestic supply, but by imported rice.

"The governments of the CARD member countries tended to focus only on increasing production and productivity. Therefore, I put much effort into sensitizing them to the importance of taking more measures to improve the quality of rice with a view to strengthening the competitiveness of domestic rice over its counterpart from Asia and stimulating local consumers' demand for local rice," Mr. Hiraoka says.

With many meetings and training opportunities over the past ten years and growing confidence of the member countries in the initiative, Mr. Hiraoka feels that such a paradigm shift has occured to some extent and started to bear fruit on the ground.

For example, the rice self-sufficiency rate in Senegal stood at only about 20 percent in the early 2000s, and the country depended on large amounts of imported rice. As the government of Senegal set its target to improve its rice self-sufficiency, JICA provided support for improving the techniques of rice-production and processing, and building a value-chain network to increase the amount of rice distribution in urban areas. These efforts have led to the rice self-sufficiency ratio rising to 39 percent (as of 2014). JICA will continue its support with a goal of achieving full self-sufficiency.

Working to again double rice production by 2030

With the demand for rice in Sub-Saharan Africa expected to continue increasing, discussions are underway for the CARD second phase, which would aim to double the annual rice production from an estimated 28 million metric tons in 2018 to 56 million metric tons by 2030. In addition to the current 23 CARD member countries, nine other countries including Angola and Sudan have expressed their intentions to participate.

"It's essential to have further improvement in the quality of rice and the distribution system and to enhance marketing. So, we would like to support the implementation of each country's strategy to stimulate rice growing and to proactively increase private sector investment," says JICA Project Formulation Advisor Takanori Satoyama, the general coordinator of the CARD Secretariat, speaking about the second phase of CARD.

Along with collaborators including the New Partnership for Africa's Development (NEPAD) Agency, which supports sustainable development in Africa, JICA will continue supporting Africa-led initiatives to encourage rice growing. The 7th CARD General Meeting, a gathering of representatives of the 32 existing and prospective CARD member countries and international development partners, was held Oct. 2-4 at the JICA Research Institute in Ichigaya, Tokyo. As CARD results were confirmed and negotiations took place on the framework of the CARD second phase, attendees decided it will begin in 2019, the year of the 7th Tokyo International Conference on African Development (TICAD 7).

Regional Economic Report (Summary) (Oct. 2018)

Bank of Japan, Thursday, October 18, 2018

This report summarizes the reports from all regional research divisions, mainly at the Bank's branches in Japan, and is based on data and other information gathered for the meeting of general managers of the Bank's branches held today. The English translation is based on the Japanese original.

October 18, 2018

Bank of Japan

According to assessments from regions across Japan, all nine regions reported that their economy had been either expanding or recovering. Compared with the previous assessment in July 2018, however, the Hokkaido and Chugoku regions revised down their assessments, taking into account the effects of the natural disasters -- namely, the 2018 Hokkaido Eastern Iburi Earthquake and the heavy rain in July 2018 -- that had affected each region, respectively. Meanwhile, the Kinki region maintained its assessment that its economy had been expanding moderately, although effects of Typhoon Jebi (Typhoon No. 21), which hit in September, were being observed. The other six regions (Tohoku, Hokuriku, Kanto-Koshinetsu, Tokai, Shikoku, and Kyushu-Okinawa) reported that their assessments were unchanged.

The background behind these assessments was that the virtuous cycle from income to spending had been maintained, as labor market conditions had continued to tighten steadily and private consumption had been increasing moderately, while exports had been on an increasing trend with overseas economies growing firmly.